The Korean cryptocurrency market, dominated by Upbit (59% market share) and Bithumb (39%), represents a critical gateway for global blockchain projects. This report analyzes the structural advantages and regulatory challenges of listing on these exchanges, with a focus on recent market trends.

1. Korean Crypto Market Overview: A 98% Market Share Duopoly

1-a. Why is Korean market so attractive?

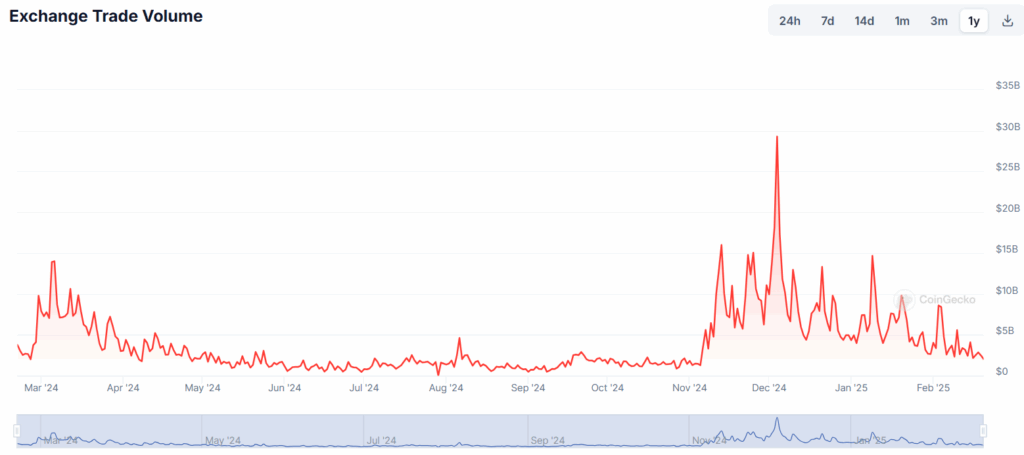

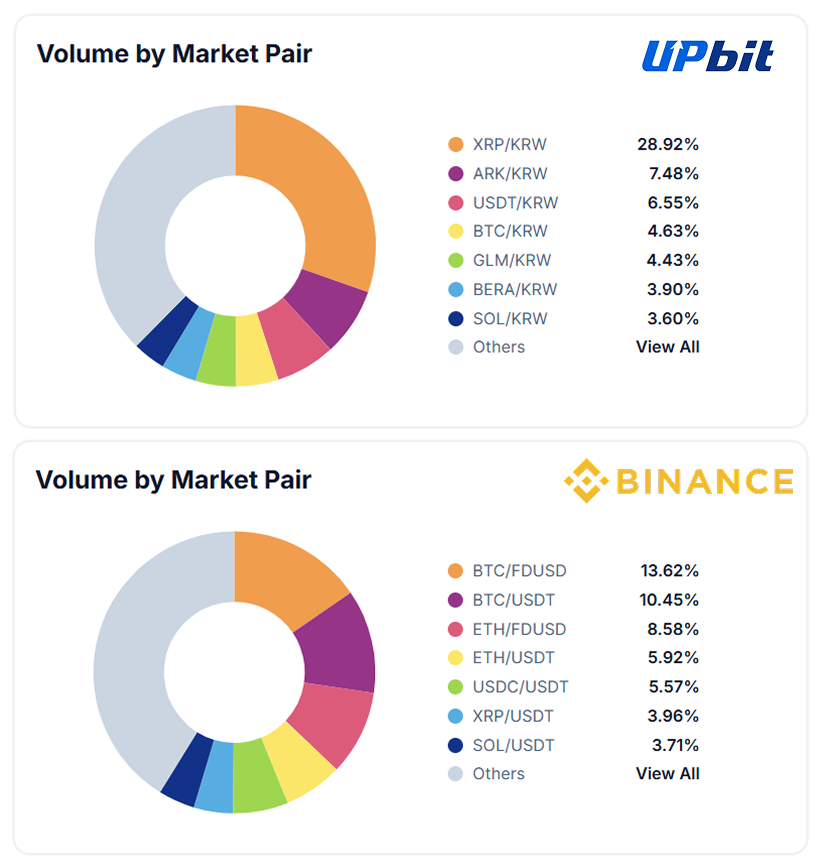

During peak on December 4, 2024, Upbit’s daily KRW volume hit ₩51.2T ($38.7B), surpassing its usual ₩10T baseline and capturing 80.5% of Korea’s total crypto volume. This surge positioned Upbit as the 2nd largest exchange by single-day retail trading intensity behind Binance, despite its smaller global footprint. By February 2025, Upbit’s market share stabilized at 59% domestically, while globally, it remained a top-10 venue for altcoin liquidity. It is also notable that while other global CEXs’ liquidity is centered around BTC, Korean crypto trading volume is centered around altcoins such as XRP. This gives a lot of hope to Altcoin founders.

1-b. Upbit vs Bithumb: Upbit and Bithumb having about 98% of the trading volume in Korea

Upbit typically takes much growing share of trading volume during bullish periods, as it is a preferred platform for Korean retail investors during market rallies, driven by its superior liquidity and reputation for security. In December 2024, Upbit’s market share surged from 56.5% to 78.2% as Bitcoin approached its all-time high, while Bithumb’s share halved from 41.2% to 19.3% during the same period. –

To boost its share in the market, Bithumb has adopted a high-risk, high-reward approach to compete with Upbit, leveraging two key tactics:

- Fee-Free Trading: Bithumb eliminated trading fees in October 2024, temporarily boosting its daily active users by 32%. However, this strategy proved unsustainable, as users returned to Upbit once the promotion ended.

- Meme Coin Listings: Bithumb leads in meme coin adoption, listing 7+ meme tokens like PONKE and SUNDOG in 2024. This strategy targets younger traders seeking high-risk, high-reward opportunities, allowing Bithumb to capture 41% of TRUMP token volume post-listing.

Despite its conservative reputation, Upbit listed 5 meme coins (PEPE, BRETT, BONK, MEW, TRUMP) between August 2024 and February 2025. This shift directly responded to Bithumb’s market share gains, as Upbit’s dominance had dropped to 59% by February 9, 2025. Upbit announced $TRUMP listing on February 13th. Analysts view this as a defensive maneuver to retain traders lured by Bithumb’s meme coin offerings.

2. Why you want to list on Upbit

2-a. Does “석우빔” exists in real?

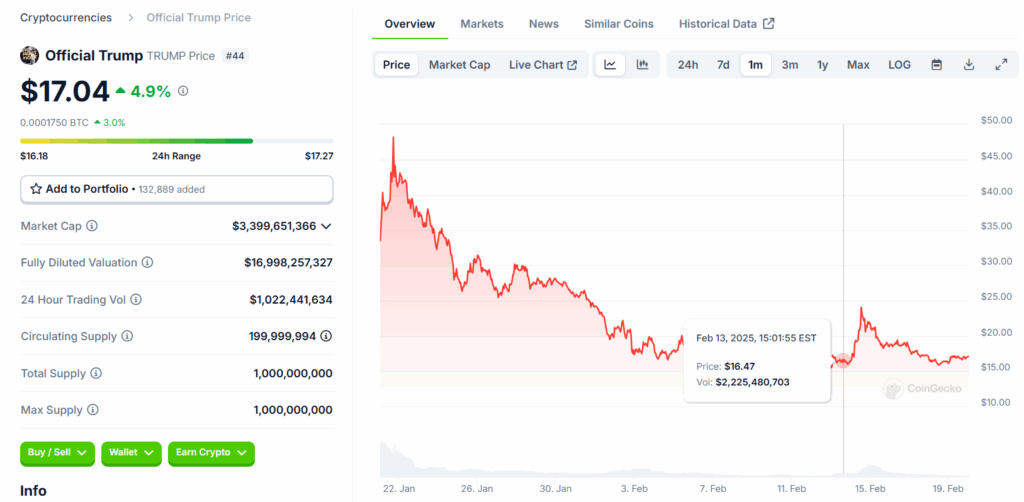

The “Seokwoo Beam” (석우빔), a term coined by Korean crypto traders, refers to the sudden price surge often observed when tokens are listed on Upbit. However, previous research indicates that analysis of 5-minute candlestick charts from listing announcements reveals a consistent pattern: most tokens experience either an immediate sharp decline or a brief uptick followed by a significant drop within 24 hours of listing.

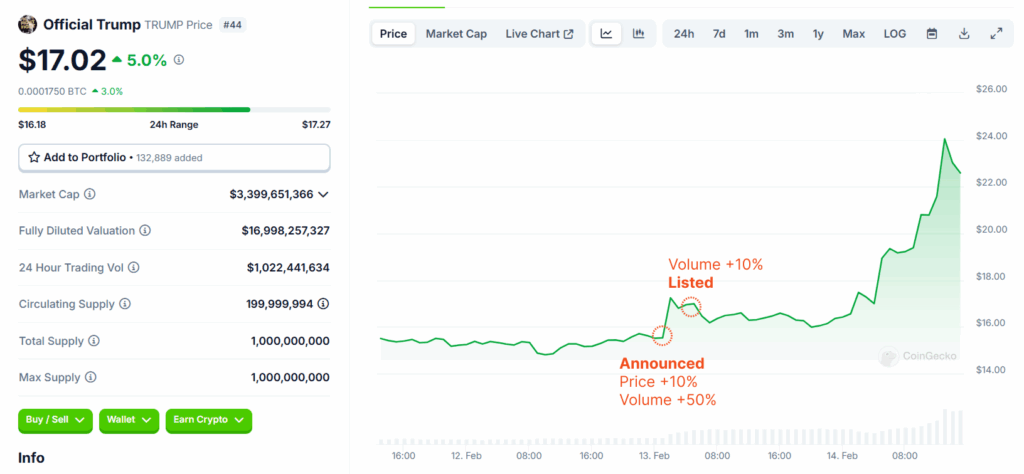

Let’s see what happened to $TRUMP after listed on Upbit on the KRW market.

Upon announcement, according to Coingecko, TRUMP’s price surged 10% while trading volume increased by 50%. Post-listing, the 24-hour trading volume skyrocketed from $1 billion to $2 billion, peaking at $6 billion the following day.

This data suggests that while the “Seokwoo Beam” may not universally affect all listings, it remains a significant market force.

2-b. Then why you want to list on Upbit?

Despite the fact that not all tokens listed on Upbit experience the “Seokwoo Beam”, it is generally true that Korean traders provide an ideal exit liquidity scenario. That is why projects continue to pursue Upbit listings due to the exchange’s unparalleled ability to drive liquidity for Altcoins. For project teams, an Upbit listing offers a prime opportunity to access substantial liquidity without severely impacting market price.

3. Recent Upbit listings and its analysis

To see if it makes sense, I analyzed few more Upbit listings this year.

| Tokens | Upbit listing announcement | Upbit listing | Price after Upbit listing (1h from listing announcement ) | Volume after listing |

|---|---|---|---|---|

| TRUMP (Official Trump) | 2025.02.13 15:24 KST | 2025.02.13 18:00 KST | +11% | +100% |

| LAYER | 2025-02-12 08:30 KST | 2025-02-12 09:00 KST | +40% | +101% |

| BERA | 2025-02-06 13:56 KST | 2025-02-06 23:50 KST | -7% | +70% |

| VIRTUAL | 2025-01-31 17:17 KST | 2025-01-31 20:00 KST | +14% | +117% |

| ANIME | 2025-01-23 18:36 KST | 2025-01-24 10:00 KST | +4% | +58% |

| SONIC | 2025-01-07 16:31 KST | 2025-01-08 14:00 KST | -8% | +24% |

(*Price changes in SONIC, ANIME, and BERA might not be exact since Upbit announced their listings before TGE)

4. High regulation pressure on domestic exchanges

Despite its “Seokwoo Beam”, listing procedures regarding major Korean exchanges remain notably rigorous. They face stringent regulatory scrutiny, largely driven by government concerns over its dominant position and compliance practices.

4-a. KYC and AML Compliance Scrutiny

The Korea Financial Intelligence Unit (FIU) is on investigation with a primary focus on Upbit’s transactions with unregistered crypto exchanges. Specifically, the FIU has raised concerns about Upbit’s interactions with overseas services or exchanges, which are classified as unregistered entities under Korean law. These platforms, offering Korean-language services without proper registration, are viewed as potential conduits for money laundering and terrorist financing, placing Upbit in a precarious regulatory position.

4-b. Market Duopoly Concerns

The concentration of market power between Upbit (78.2% market share) and Bithumb (19.3%) has drawn criticism from lawmakers. During a recent parliamentary session, a member of the National Assembly highlighted this duopoly, expressing concerns about potential market manipulation and the need for increased competition in the Korean crypto ecosystem.

4-c. Personal Analysis

While regulatory intervention to prevent duopoly in the crypto market makes sense, proposals for government control over listing criteria is insane. It seems they fundamentally lack understanding in cryptocurrency dynamics. Similarly, the focus on KYC and AML enforcement appears misdirected; rather than targeting compliant exchanges like Upbit, authorities should prioritize action against non-compliant exchanges or services. This suggests a regulatory strategy more focused on easy targets than addressing the root causes of compliance issues in the global crypto market.

Then how?

The regulatory landscape for cryptocurrency exchanges in Korea is becoming increasingly stringent, with financial authorities tightening their grip on compliance and market practices. Thus, direct listing brokerage has become extremely risky; any individual claiming to facilitate listings might be scamming projects or at least misinforming since the brokerage will cause a big trouble.

Given this, the only viable path for projects seeking a listing on two major Korean exchanges is to build trust and cultivate a strong community presence within the Korean crypto ecosystem and organically capture the attention of their listing committee members. The strategy involves developing a robust Korean user base, engaging with local crypto media, and demonstrating project legitimacy through transparent operations and community engagement.

Our next research piece will delve into specific strategies and best practices for building this trust and community presence in the Korean cryptocurrency market.